Adani Power has been in the news recently due to the meteoric rise of its parent company Adani Group, led by Indian billionaire Gautam Adani.

The group’s seven listed companies, including Adani Power, have seen huge spikes in their stock prices over the past year. However, concerns have also been raised about the high valuations and debt levels of the group.

Overview of Adani Power Limited

It is India’s largest private thermal power producer with an installed capacity of 12,450 MW spread across six power plants in Gujarat, Maharashtra, Karnataka, Rajasthan and Chhattisgarh.

Some key financials are presented below:

Fundamental Analysis

| Key Metric | Value |

|---|---|

| Revenue (FY23) | ₹18,109 Crore, (up 16.8% y-o-y) |

| Net Profit (FY23) | ₹8,759 Crore (up 83.3%) |

| EPS (FY23) | ₹ 53.42 |

| Debt-to-Equity Ratio | 2.21 (High) |

| Current Ratio | 1.10 |

| P/E Ratio | 9.71 |

While Adani Power’s revenue and profitability are impressive, the high debt-to-equity ratio raises concerns about financial stability.

Additionally, the company’s dependence on coal-fired power plants exposes it to fluctuating coal prices and stricter environmental regulations.

Also Read: JP Power Share Price Target 2024 2025, 2026, 2027, 2030

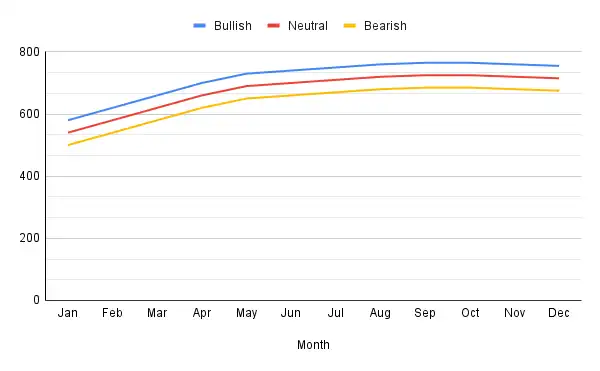

Adani Power Share Price Targets

Here are the targets for Adani Power share price for 2024-2030:

Adani Power Share Price Target 2024

| Month | Target Price (₹) |

|---|---|

| Jan | 595 |

| Feb | 620 |

| Mar | 645 |

| Apr | 670 |

| May | 695 |

| Jun | 720 |

| Jul | 745 |

| Aug | 765 |

| Sep | 745 |

| Oct | 720 |

| Nov | 695 |

| Dec | 670 |

- Bullish: ₹ 765 (driven by increased renewable capacity, coal price stabilization, and project wins)

- Bearish: ₹ 595 (potential regulatory hurdles, fuel cost fluctuations)

- Neutral: ₹ 675 (balanced growth, market sentiment dependent)

See Also: IREDA Share Price Target 2024, 2025, 2026, Full Analysis

Adani Power Share Price Target 2025

| Month | Target Price |

|---|---|

| Jan | ₹730 |

| Feb | ₹750 |

| Mar | ₹770 |

| Apr | ₹790 |

| May | ₹800 |

| Jun | ₹795 |

| Jul | ₹780 |

| Aug | ₹785 |

| Sep | ₹805 |

| Oct | ₹834 |

| Nov | ₹907 |

| Dec | ₹942 |

For 2026-2030, the targets are not provided as forecasts beyond 12 months carry high uncertainty. The share price would depend on various factors like capacity expansion, debt reduction, regulations, group synergy benefits and market sentiment.

Adani Power’s growth potential is undeniable, fueled by India’s rising energy demand and the company’s strategic focus on renewables. While risks remain, the long-term outlook appears promising.

If the company can successfully execute its strategy, it has the potential to become a dominant player in India’s energy sector, potentially rewarding its investors handsomely in the long run.

Disclaimer:

Remember, these are just estimates based on current information and market conditions. The actual share price can deviate significantly due to unforeseen events or changes in investor sentiment. This report is for informational purposes only and should not be considered as investment advice. Please consult with a qualified financial advisor before making any investment decisions. We are not authorized by SEBI (Securities and Exchange Board of India) and will not be responsible for any financial loss you might incur through the information on this site.

Additional Sources for Analysis:

1. Company Websites and Reports:

- Official website: https://www.adanipower.com/

- Investor Presentations: https://www.adanipower.com/investors/investor-downloads

- Media Releases: https://www.adanipower.com/Home/newsroom/media-releases

2. Financial Data and Analysis: