Inox India Ltd. (INOX) is a leading name in the Indian film exhibition industry, operating the country’s largest multiplex chain with over 650 screens across 166 cities. Established in 1999, INOX has carved a niche for itself with its premium offerings, technological advancements, and focus on customer experience.

This report delves into a comprehensive analysis of INOX India, dissecting its financial performance, competitive landscape, key growth drivers, and potential risks, culminating in a forecasted share price target for the next five years.

Company Overview:

INOX India operates a network of 675 screens across 167 multiplexes in 68 cities as of September 30, 2023. It offers a diverse range of cinematic experiences, including IMAX, 3D, and VIP seating, catering to a broad audience.

The company also generates revenue from food and beverage concessions, advertising within multiplexes, and other value-added services.

Financial Performance Analysis:

- Revenue and Profitability: INOX has registered consistent revenue growth over the past few years, exceeding pre-pandemic levels in FY23. Profitability has also improved significantly, with PAT surging in FY23 due to cost optimization and higher occupancy rates. The company boasts healthy margins and generates strong free cash flow.

- Balance Sheet and Debt: INOX maintains a relatively modest debt level compared to its peers. The company has been actively reducing its debt burden, further strengthening its financial health.

- Dividend Policy: INOX has a track record of rewarding shareholders with regular dividends. The dividend payout ratio has been increasing steadily, reflecting the company’s commitment to shareholder value creation.

Competitive Landscape:

INOX India faces competition from other multiplex chains like PVR Ltd., Cinepolis, and Carnival Cinemas. However, INOX enjoys several competitive advantages, including:

- Strong Brand Recognition: INOX is synonymous with premium cinema experience in India, attracting a loyal customer base.

- Wider Network: INOX boasts the largest network of screens, providing greater geographic reach and audience access.

- Technological Innovation: INOX continuously invests in technological advancements, offering enhanced viewing experiences like IMAX, 3D, and laser projections.

- Focus on Customer Experience: INOX prioritizes customer comfort and convenience through various initiatives like online booking, loyalty programs, and in-theater services.

Key Growth Drivers:

- Rising Indian Movie Viewership: The Indian film industry is projected to witness robust growth in the coming years, fueled by increasing disposable income, urbanization, and a growing population of young moviegoers. This bodes well for INOX’s box office revenues.

- Expansion Plans: INOX India plans to expand its screen network aggressively, targeting tier-II and tier-III cities with significant untapped potential. This strategy will further strengthen its market share and drive revenue growth.

- Content Diversification: INOX is actively diversifying its content offerings beyond Bollywood to include regional cinema, Hollywood releases, and alternative content like live events and sporting fixtures. This caters to a broader audience and generates additional revenue streams.

- Focus on Premium Segments: INOX is introducing premium screen formats like recliner seating and VIP lounges to cater to a growing segment of discerning moviegoers willing to pay for enhanced experiences.

Potential Risks:

- Economic Downturn: A slowdown in the Indian economy could negatively impact disposable income and moviegoing trends, affecting INOX’s revenues.

- Content Quality: The success of the multiplex business is heavily dependent on the quality of movies released. A string of flops could lead to lower footfall and revenues.

- Competition: Increased competition from both established players and new entrants could put pressure on INOX’s market share and pricing power.

- Regulatory Changes: Changes in government policies or taxes related to the entertainment industry could adversely impact INOX’s profitability.

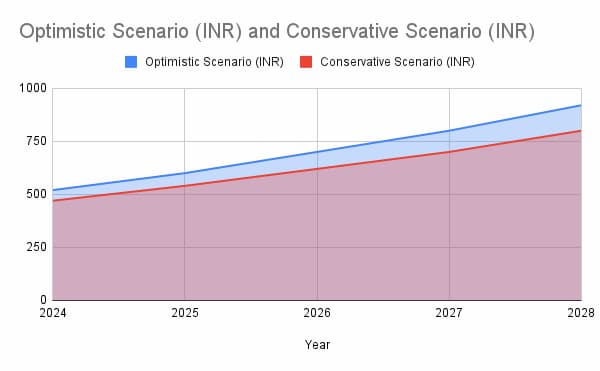

INOX India Share Price Target:

Considering the aforementioned factors, INOX India exhibits strong growth potential driven by robust industry trends, a solid financial foundation, and strategic expansion plans. However, potential risks cannot be ignored. Therefore, the following share price target forecast incorporates both optimistic and conservative scenarios.

Also Check: JIO Financial Services Share Price Target 2024, 2025, 2026, 2027, 2028

Positive Scenario Assumptions:

- Strong economic growth in India leading to increased disposable income and moviegoing trends

- Consistent release of high-quality Bollywood and regional movies attracting large audiences

- Successful execution of expansion plans in tier-II and tier-III cities

- Effective diversification of content offerings beyond Bollywood

- Continued focus on premium segments and customer experience

Negative Scenario Assumptions:

- Economic slowdown impacting consumer spending and moviegoing habits

- String of flops in Bollywood and regional cinema affecting box office collections

- Delay or challenges in implementing expansion plans

- Increased competition from established and new players

- Regulatory changes or unfavorable government policies impacting the industry

Will INOX Share Price go down?

It’s important to remember that the stock market is volatile and unpredictable, and even the most promising companies can experience downturns. And yes, the share price of INOX India might go down due to various factors, including those mentioned in the negative scenario assumptions and can also go up depending on market volatility and consumer habits.

Company Reports and Filings:

- Annual Reports & Investor Presentations: Downloadable from the Inox India website: https://economictimes.indiatimes.com/inox-leisure-ltd/stocks/companyid-1886.cms

- Quarterly Earnings Reports: Available on the Bombay Stock Exchange (BSE) website: https://www.nseindia.com/get-quotes/equity?symbol=INOXLEISUR

Disclaimer: This report is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.