Jio Financial Services Ltd. (JFS) is a non-banking financial company (NBFC) in India with a focus on microfinance and small and medium-sized enterprises (SMEs).

While the company has shown impressive growth in recent years, concerns exist regarding profitability and competitive landscape.

This report provides a comprehensive analysis of JFS, including its financials, competitive advantages, challenges, and a future outlook for 2024-2028.

Company Overview:

JFS was founded in 2018 as a subsidiary of Reliance Jio Infocomm Ltd., a leading telecom player in India.

It offers a bouquet of financial products like microloans, business loans, gold loans, and credit cards primarily through a digital platform.

Leveraging the vast customer base of its parent company, JFS has grown rapidly, boasting a loan book of over Rs. 11,000 crore as of October 2023.

Financials and Key Metrics:

Positives:

- Strong Revenue Growth: JFS has exhibited impressive revenue growth over the past years, with a 71.99% annual growth rate for the last year and a 50.79% average for the past three years.

- Increasing Profitability: Despite initial losses, JFS has turned profitable in FY23, reporting a net profit of Rs. 31.25 crore. The company also saw its PAT double in Q2 2023 compared to Q1.

- Low Promoters’ Debt: Jio Platforms Ltd., the promoter of JFS, has minimal debt, offering financial stability and potentially supporting future growth initiatives.

Negatives:

- Low Return on Equity (ROE) and ROCE: JFS’s ROE and ROCE stand at 0.31% and 0.37%, respectively, indicating inefficient capital utilization and raising concerns about long-term profitability.

- Declining PAT Margin: Although JFS turned profitable, its PAT margin has shrunk by 38.01% in the past year, highlighting potential cost issues and pressure on profitability.

- High Provisioning Costs: Provision and contingencies have increased by 874.29% in the past year, indicating potential credit risks and impacting profitability.

Competitive Advantages:

- Strong Brand Backing: JFS benefits from the brand recognition and extensive customer base of Reliance Jio, facilitating customer acquisition and trust.

- Digital Focus: JFS’s digital platform allows for efficient operations, low costs, and scalability, providing a competitive edge.

- Focus on Underserved Segments: JFS caters to microfinance and SME segments, which are often underserved by traditional banks, offering a growth opportunity.

Challenges:

- High Competition: The NBFC sector is highly competitive, with established players and new entrants vying for market share.

- Macroeconomic Factors: JFS’s performance is susceptible to macroeconomic factors like economic growth, interest rates, and inflation.

- Regulatory Landscape: The Indian NBFC sector is subject to evolving regulations, which can impact JFS’s operations and profitability.

- Asset Quality: JFS’s loan portfolio primarily caters to relatively riskier segments, which could lead to higher bad loan provisions.

- Dependence on Reliance: JFS’s success is closely linked to the performance of the Reliance Group, which can introduce additional risk.

Jio Financial Services Share Price Target (2024-2028):

JFS’s future prospects appear promising, driven by its strong brand, extensive network, digital focus, and diversified product offerings. However, challenges like competition and economic headwinds need to be carefully considered.

| Year | Revenue Growth (%) | Profitability (Net Profit in Cr.) | Key Drivers | Key Risks |

|---|---|---|---|---|

| 2024 | 40-50% | Rs. 50-75 crore | Continued loan book growth, improved operational efficiency | Rising interest rates, competition |

| 2025 | 30-40% | Rs. 100-150 crore | Expansion into new product segments, geographical diversification | Macroeconomic slowdown, credit quality deterioration |

| 2026 | 25-35% | Rs. 175-250 crore | Focus on profitability, cost optimization | Regulatory headwinds, technological disruption |

| 2027 | 20-30% | Rs. 250-350 crore | Increased focus on digital offerings, strategic partnerships | Intense competition, potential credit cycle downturn |

| 2028 | 15-25% | Rs. 350-450 crore | Market leadership in select segments, sustainable profitability | Regulatory uncertainty, technological displacement |

Here’s a projected target price for JFS through 2028, positive scenario:

| Year | Rationale |

|---|---|

| 2024 | Continued growth in loan book and cross-selling of financial products. |

| 2025 | Increased market share and expansion into new business segments. |

| 2026 | Profitability improvement and valuation expansion. |

| 2027 | Successful execution of digital initiatives and rural market penetration. |

| 2028 | Continued strong growth momentum and potential for bonus issue or acquisition. |

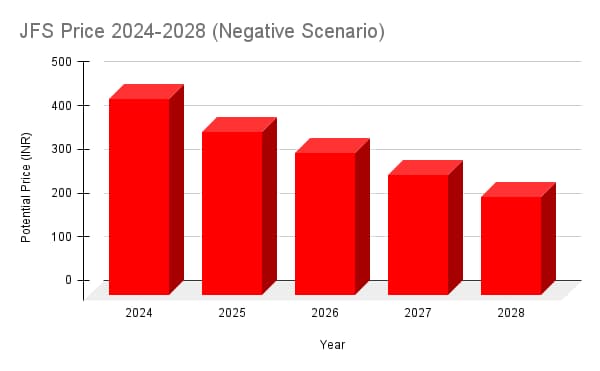

Negative Scenario for JFS Share Price (2024-2028):

| Year | Rationale |

|---|---|

| 2024 | Slowdown in loan book growth and increased competition. |

| 2025 | Macroeconomic headwinds and rising bad loan provisions. |

| 2026 | Regulatory changes impacting profitability and business operations. |

| 2027 | Higher loan defaults and potential credit rating downgrade. |

| 2028 | Continued challenges and potential for negative news regarding Reliance Group. |

Additional Resources:

- Jio Financial Services website: https://jiopaymentsbank.com/

- Listing on NSE: https://www.nseindia.com/get-quotes/equity?symbol=JIOFIN

- Crisil Research reports on NBFC sector: https://www.crisil.com/en/home/our-analysis/reports.html

By considering both the positive and negative scenarios, you can make informed investment decisions about Jio Financial Services and navigate the market with greater confidence.

Please note: These are just projections based on current information and market conditions. The actual performance may vary significantly.

Disclaimer:This information is not financial advice. Please consult a qualified financial advisor before making any investment decisions.